Modeling Battery Storage Economics: Is FEOC Compliance Worth the Premium?

Buying FEOC-compliant batteries vs. lower cost sourcing

By GridVest — Analysis and calculations by Enerlogics (Scott Ameduri).

Source: GridVest + Enerlogics 2026 Battery Storage Planning webinar.

With the One Big Beautiful Bill (OBBB) and changes to ITC-eligibility, the tax landscape for commercial & industrial (C&I) and utility-scale battery storage projects has fundamentally changed. Foreign Entities of Concern (FEOC) rules create new procurement tension: FEOC-compliant equipment costs more but is likely less proven in the field; while lower-cost, FEOC options may forfeit the ITC but may have a longer track record, with more system integrations, UL Certifications and large-scale fire testing.

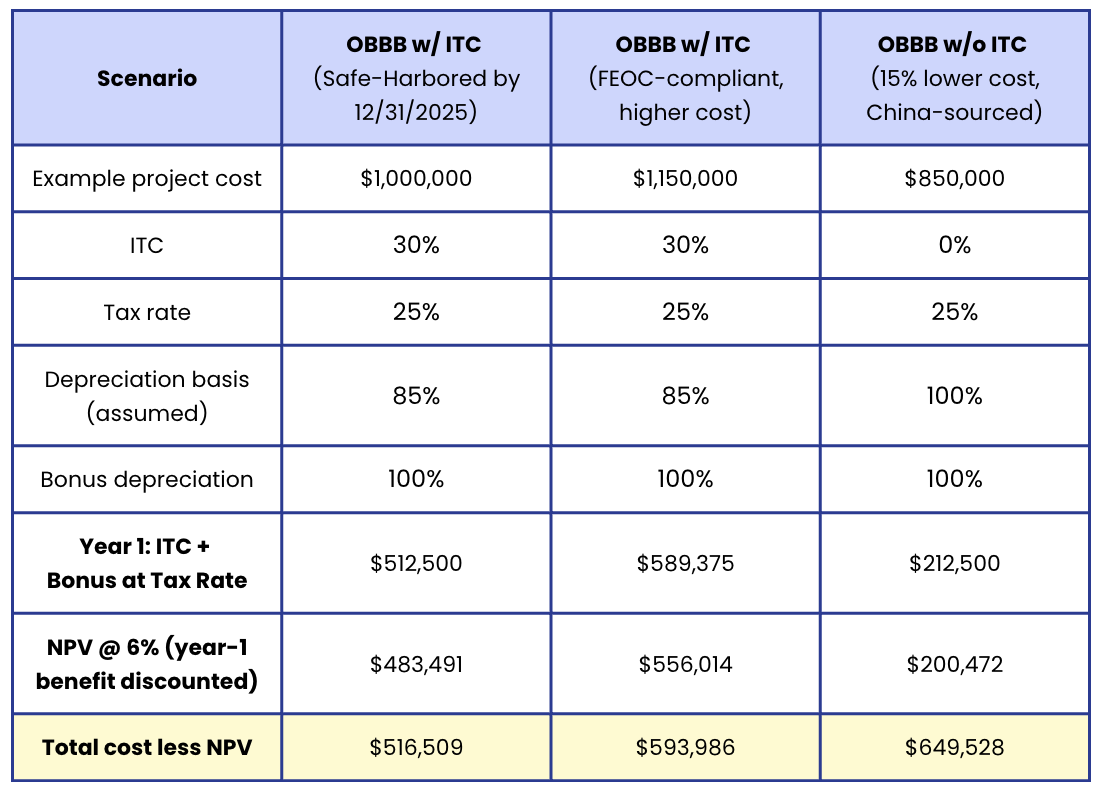

To help developers, investors, and owners navigate these tradeoffs, we ran three straightforward modeling cases that isolate upfront economics (ITC + bonus depreciation + tax effects) and show where the decision points are.

Below, we explain the considerations and drivers, and offer a short checklist for applying this to your own projects. If you want to layer revenue streams beyond upfront cost savings (arbitrage, demand reduction, capacity, DR, resilience), see our primer on value stacking for 2026 planning here.

What changed — three anchors that developers need to understand for OBBB

Reinstating 100% bonus depreciation: accelerates depreciation into year one and materially increases the year-one tax shield. That front-loads value and improves project payback.

ITC remains available for storage: a 30% ITC on eligible projects still moves the needle — but only if your project meets the eligibility rules (Safe Harbor, FEOC compliance where required).

FEOC & supply chain constraints: FEOC-compliance rules (required for projects that start construction after 1/1/2026 and that did not Safe Harbor), with fewer compliant suppliers for LFP cells and battery modules, equates to high demand, long lead times, higher costs of manufacturing outside of China, and ultimately translating to higher equipment costs.

The result: developers must explicitly model whether the ITC + depreciation advantage outweighs the premium for FEOC compliance — and in many cases, both routes may be economically reasonable.

Three model cases

The example here focuses on upfront economics only — the interaction of project cost, the 30% ITC (when available), tax rate, and the tax shield from bonus depreciation. These are presented as year-one benefits and their present values discounted at 6%. Life-of-asset revenue stacking and bankability/risk factors are not included in this model.

Source: Scott Ameduri, Enerlogics

Assumptions are a tax rate of 25% and bonus depreciation of 100%. The FEOC-compliant case assumes a material equipment premium; the non-ITC case assumes a 15% lower equipment cost versus today’s baseline.

So how do these compare? Our takeaways

Tax timing matters a lot. With 100% bonus depreciation and a 30% ITC, the Safe Harbor example reduces the effective net cost from $1.0M to about $516k in present value terms. That’s nearly a 48% offset of gross cost and can turn marginal projects into clear winners. This is our benchmark comparison to the economics that companies have been accustomed to over the last few years.

FEOC compliance has a real price. If FEOC-compliant equipment raises project costs by a material amount (we used +15% in the example), the net cost after tax benefits climbs (to ~$594k in the example). You still capture the ITC, but your net outlay is expected to be higher.

Lower cost with no ITC can compete. A cheaper, FEOC solution that forgoes the ITC (model assumes −15% cost) can land at a similar or higher net cost, depending on the numbers — in the example, it yields ~$650k net. In other words, the tradeoff band is tight: suppliers’ cost differentials of ~15% can flip your decision.

Our main takeaway: the cost differentials aren’t too wide between the scenarios, so it’s worth evaluating the two models if you haven't been able to Safe Harbor.

But keep in mind that this analysis only captures upfront economics, but there are ways to continue offsetting these costs over time. Lifecycle revenue (arbitrage, demand charge reduction, capacity revenues, DR, incentives), durability, warranty, financing terms, and insurance are often factors as well. See our 2026 planning and revenue generation streams for BESS here.

Bottom line

The 100% bonus depreciation and continued ITC availability are powerful economic levers for battery projects — but FEOC compliance and supply-chain realities mean the right procurement path is not automatic. Our models show a narrow band between alternatives if lifecycle and bankability risks can be managed.

If you’d like GridVest to review comparisons and help deliberate the best path(s) for your BESS project, drop us a note.

Disclaimer: This article is informational and does not constitute legal, tax, or investment advice. Model outputs depend on assumptions — consult your tax and legal advisors before acting.